1/22/2026

For investors and Web3 enthusiasts, tracking these "mega-wallets" is essential for predicting market cycles. The concentration of Bitcoin into ETFs and Strategic Reserves suggests that the asset is becoming less of a "volatile currency" and more of a "permanent reserve asset."

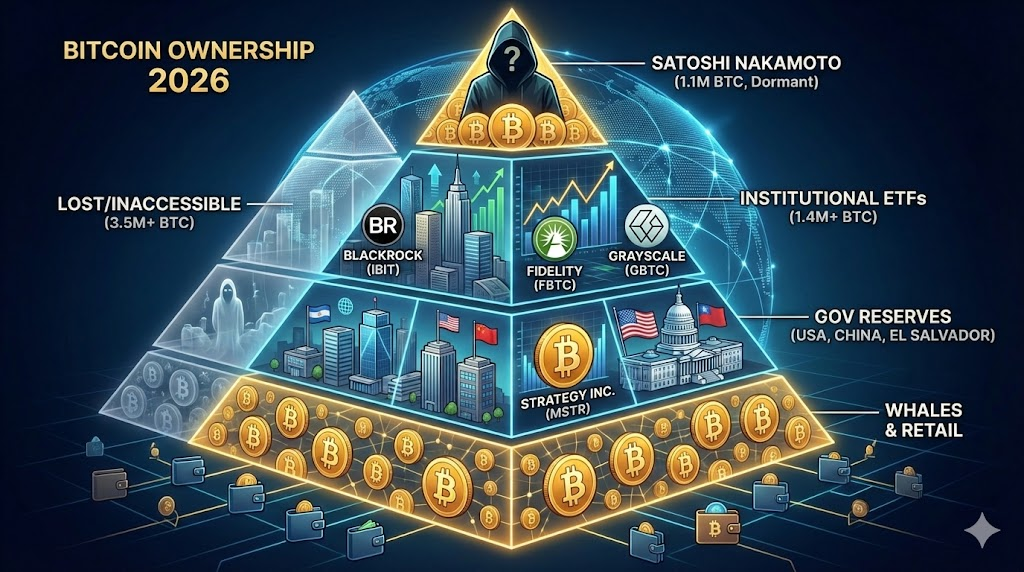

The circulating supply of Bitcoin is hard-capped at 21 million, but the question of who actually controls those coins has shifted from a matter of curiosity to a critical metric for global financial stability. In 2026, the landscape of Bitcoin ownership has undergone a radical transformation. What was once the domain of cypherpunks and early adopters is now a battlefield for nation-states, trillion-dollar asset managers, and public corporations.

Understanding the distribution of Bitcoin is not just about tracking wealth; it is about understanding the "institutionalization" of the world’s first digital commodity. Here is the definitive breakdown of the largest Bitcoin holders as of January 2026.

The Genesis Whale: Satoshi Nakamoto’s 1.1 Million BTC

The largest single entity in the Bitcoin ecosystem remains its pseudonymous creator, Satoshi Nakamoto. Between 2009 and 2010, Nakamoto mined an estimated 1.1 million BTC across thousands of different wallets.

As of January 2026, these coins remain completely untouched. This massive stockpile represents roughly 5.2% of the total supply. While these coins are worth over $100 billion at today’s valuations, the "Satoshi stash" is widely regarded as a "dead supply." If even a single satoshi from these wallets were to move, it would likely trigger unprecedented volatility across the global crypto markets.

The New Vanguard: Wall Street and the ETF Explosion

The approval of spot Bitcoin ETFs in 2024 was the "Big Bang" moment for institutional ownership. By early 2026, the concentration of BTC in the hands of regulated fund managers has surpassed nearly all other categories.

- BlackRock (iShares Bitcoin Trust - IBIT): BlackRock currently sits at the top of the institutional pyramid, holding approximately 778,000 BTC. Their IBIT fund has become the primary vehicle for pension funds and sovereign wealth funds to gain exposure to Bitcoin without the complexities of self-custody.

- Fidelity (Wise Origin Bitcoin Fund - FBTC): Fidelity follows closely with roughly 472,000 BTC. Unlike many competitors, Fidelity manages its own custody infrastructure, making them a unique powerhouse in both the financial and technical layers of the network.

- Grayscale (GBTC): Despite years of outflows as investors migrated to lower-fee options, Grayscale still retains a significant war chest of roughly 218,000 BTC.

Corporate Treasuries: The Rise of Strategy Inc. (MSTR)

The concept of "Bitcoin as a treasury reserve asset" has moved from a fringe theory to a standard corporate strategy. No company embodies this shift more than Strategy Inc. (formerly MicroStrategy).

Under the aggressive leadership of Michael Saylor, Strategy Inc. has utilized "at-the-market" stock offerings and Bitcoin-backed credit instruments to accelerate its accumulation. As of January 20, 2026, the company holds a staggering 709,715 BTC. To put this in perspective, this single public company now controls more than 3% of the entire Bitcoin supply—outpacing most nation-states.

Other notable corporate holders include:

- MARA Holdings: The world’s leading miner, holding over 53,000 BTC as part of their "HODL" strategy.

- XXI (Twenty One Capital): A specialized investment firm with roughly 43,514 BTC.

- Metaplanet: The "MicroStrategy of Asia," which has aggressively acquired over 35,000 BTC to hedge against yen volatility.

Nation-States: From Seizures to Strategic Reserves

2025 marked a turning point in how governments perceive Bitcoin. We have moved from the era of "seize and sell" to the era of "strategic accumulation."

The United States Strategic Bitcoin Reserve

Following the 2025 executive orders and the passing of the GENIUS Act, the U.S. government officially shifted its policy. Instead of auctioning off coins seized from criminal cases (like the Silk Road or Bitfinex hacks), the U.S. has established a Strategic Bitcoin Reserve. Currently, the U.S. government is the largest sovereign holder, with an estimated 328,372 BTC.

Other Major State Holders

- China: While the official stance remains complex, the Chinese government is estimated to hold approximately 194,000 BTC, largely recovered from the 2020 PlusToken crackdown.

- The United Kingdom: The UK holds roughly 61,000 BTC, primarily through law enforcement seizures.

- Kingdom of Bhutan: Bhutan has emerged as a unique player, using its vast hydroelectric resources to mine Bitcoin. It currently holds over 13,000 BTC.

- El Salvador: As the first nation to adopt BTC as legal tender, El Salvador continues its "1 BTC a day" purchase program, currently holding 6,363 BTC.

The Individual "Whales" and Bitcoin Billionaires

Despite the institutional takeover, several individuals still hold massive influence.

- The Winklevoss Twins: Founders of Gemini, they are estimated to hold around 70,000 BTC.

- Tim Draper: The venture capital legend who famously bought the Silk Road auction coins, holding approximately 29,500 BTC.

- Tether (Private Holding): While a private company rather than an individual, Tether’s role is vital. To back the USDT stablecoin, they have accumulated over 96,000 BTC, making them one of the most powerful private entities in the space.

The Scarcity Factor: The "Lost" Millions

When discussing who owns the most Bitcoin, we must account for the estimated 3.5 to 4 million BTC that are likely lost forever. These are coins stored in wallets where the private keys have been forgotten, or the owners have passed away without leaving access. This "ghost supply" further shrinks the actual available Bitcoin, making the holdings of the entities listed above even more significant in terms of percentage of the tradable supply.

Summary: Why Bitcoin Distribution Matters in 2026

For investors and Web3 enthusiasts, tracking these "mega-wallets" is essential for predicting market cycles. The concentration of Bitcoin into ETFs and Strategic Reserves suggests that the asset is becoming less of a "volatile currency" and more of a "permanent reserve asset."

As more supply is locked away by long-term institutional and state holders, the "liquidity crunch" becomes a real possibility, potentially driving the price toward the $1 million mark as predicted by many industry analysts for the 2030-2040 window.