10/21/2025

Anyone can launch a crypto asset today, from a simple speculative meme token to a complex proprietary blockchain, but success demands strict legal compliance and navigating extreme market and technical risks.

The ability to create and issue a digital currency is one of the most powerful features of blockchain technology. No longer restricted to major corporations or financial institutions, this capability is now accessible to the average individual. If you are fortunate enough to operate in a jurisdiction where cryptocurrency issuance is legally permissible, here is a detailed breakdown of the three primary pathways to launch your own asset, progressing from the simplest to the most complex, along with a candid assessment of the risks involved.

🛑 Critical Preliminary Warning: Legal & Financial Compliance

Before embarking on any technical journey, you must face the reality of regulation. The primary distinction you must understand is how your asset is classified:

- The Securities Test: If your asset is deemed a "Security" by regulatory bodies (such as those governing investments or capital markets), you will be subject to rigorous laws regarding registration, financial disclosure, and investor protection. Failure to comply can result in severe legal consequences, including charges of illegal public offering or fraud.

- Anti-Money Laundering (AML) & Know Your Customer (KYC): Depending on your asset's function, you may have obligations to prevent its use in illicit activities.

- Taxation: All proceeds from issuance, sales, and subsequent trading activities must be accurately reported.

Mandatory Advice: Consult with specialized legal and financial counsel in your operating territory before making any public announcement or taking investment.

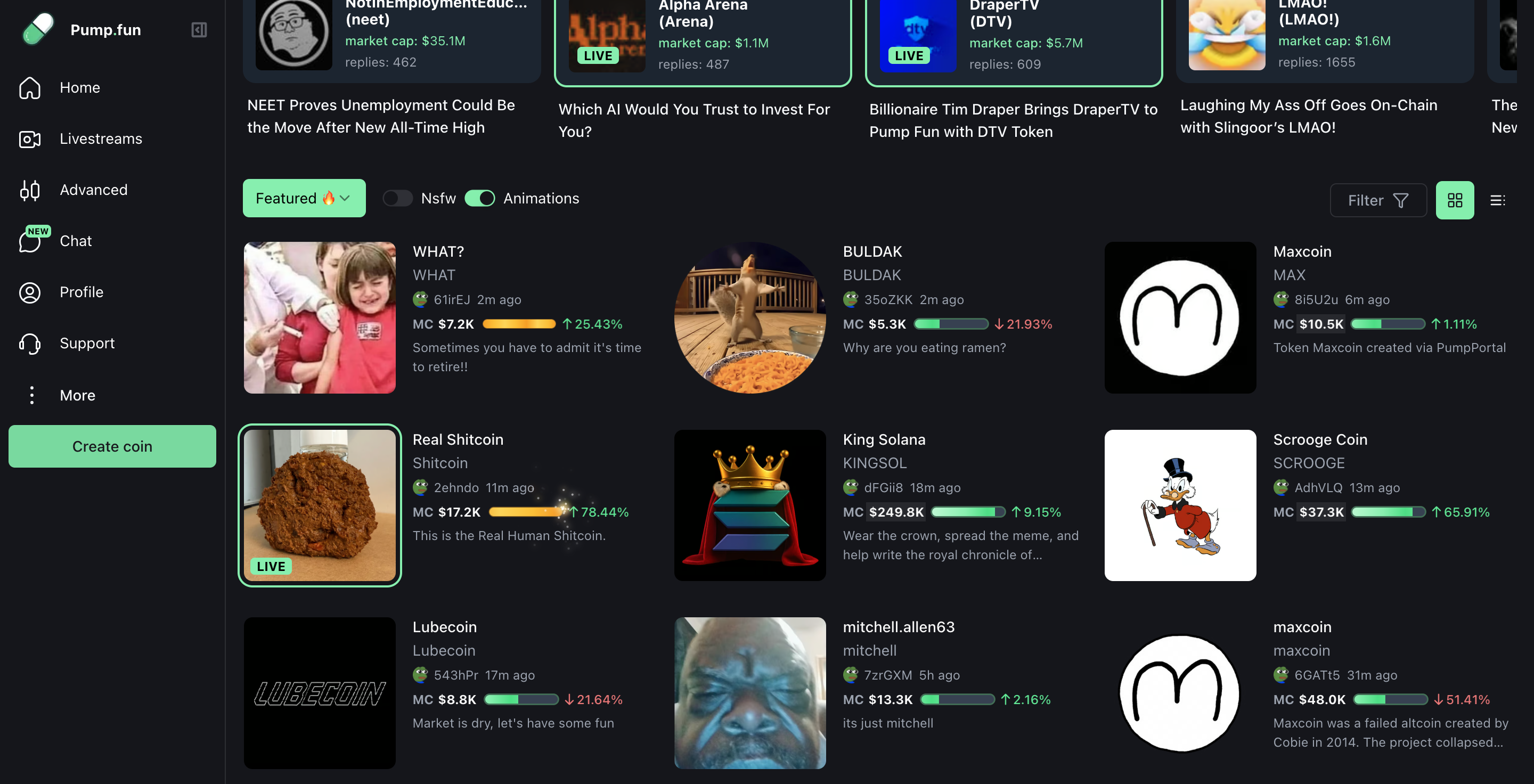

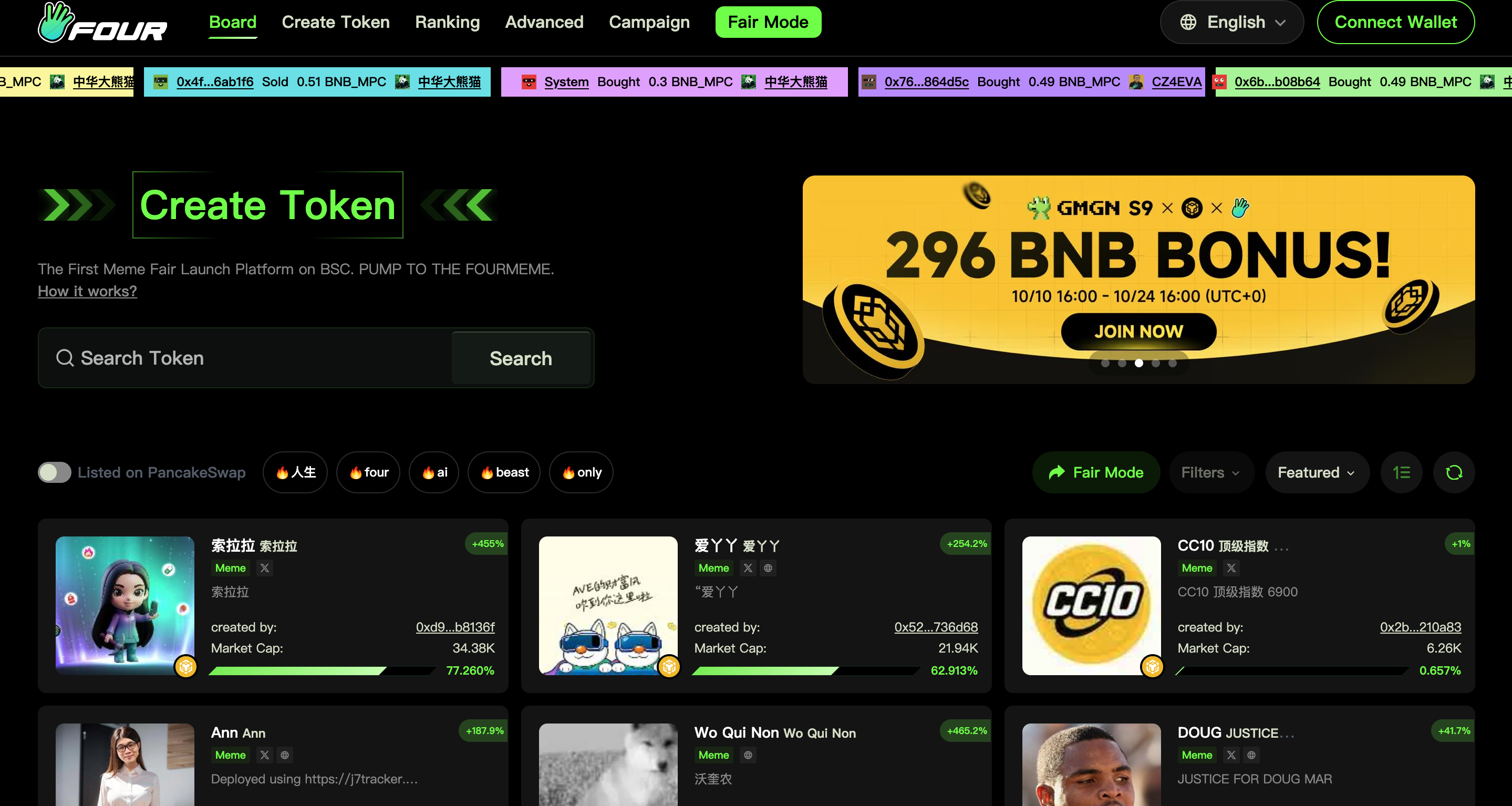

Path 1: The Absolute Easiest – The "One-Click" Meme Coin Launch

This method represents the ultimate low-barrier entry point, ideal for pure community-driven, highly speculative, or purely cultural/meme projects. It requires virtually no technical expertise.

The Mechanism: Automated Liquidity via Bonding Curves

Platforms like Pump.fun (on Solana) or Four.meme (on BNB Chain) have pioneered this automated method, which fundamentally simplifies the process of issuance and liquidity provision.

- Zero-Code Creation: The user interface allows you to define your asset's basic attributes—name, ticker, and image—without writing a single line of smart contract code.

- The Bonding Curve: Your coin is immediately tradable because it is launched onto a special smart contract known as a bonding curve. This contract is the automatic market maker: it dictates that the price rises incrementally with every purchase and falls with every sale.

- Fair Launch Principle: The money used for buying flows directly into the contract, which acts as the asset's locked liquidity pool. Crucially, there are no private pre-sales, team allocations, or venture capital discounts, theoretically ensuring that everyone is on an equal footing.

Risk Profile (Extreme Volatility):

This pathway is characterized by immense risk. The vast majority of coins launched this way are purely speculative experiments that fail within days or hours. Success depends entirely on unpredictable viral hype, and the chances of permanent capital loss are exceedingly high.

Path 2: The Standard Approach – Issuing a Token via Smart Contract

This is the most common and professionally adopted method. It suits projects aiming to build Decentralized Finance (DeFi) applications, GameFi ecosystems, or specific utility protocols.

The Technology: Leveraging Smart Contracts

Instead of building a new chain, you utilize the proven and secure infrastructure of a major existing blockchain (such as Ethereum, Polygon, or BNB Chain) to deploy a Token.

- Standardized Contracts: The easiest approach involves using well-established standards like ERC-20 (for fungible tokens) or ERC-721/ERC-1155 (for Non-Fungible Tokens, NFTs). These standards guarantee compatibility with almost all wallets, exchanges, and decentralized applications (dApps).

- Low-Code Implementation: Developers rarely write these contracts from scratch. Instead, they leverage audited open-source libraries (like OpenZeppelin). An individual with basic coding knowledge (or willing to hire a freelancer) can modify these templates to define critical parameters like total supply, decimal places, and governance features (e.g., enabling or disabling future minting).

- Deployment: The compiled contract code is sent to the blockchain network via a web interface or development tool (like Remix). The only significant cost is the Gas Fee, which is paid in the network's native currency (ETH, BNB, etc.).

Risk Profile (Technical and Market Risk):

While less volatile than meme coins, this path carries significant technical risk:

- Security Vulnerabilities: Even minor, unintended changes to the template code can create security holes that allow attackers to drain funds or exploit the token supply. Mandatory security audits are necessary but costly.

- Liquidity Management: The issuer must manually pair the new token with a base currency and lock that pair into a liquidity pool on a DEX. If this pool is too small, the token will be impossible to trade effectively.

- Utility & Adoption: Without a clear, valuable use case and a dedicated community, the token will quickly lose relevance and value.

Path 3: The Highly Complex Route – Creating a Native Coin and New Blockchain

This is the most ambitious and demanding path, reserved exclusively for well-funded institutions or highly experienced teams aiming to develop a fundamental, new piece of infrastructure (a Layer-1 or Layer-2 network).

The Asset: A Coin on its Own Chain

You are not issuing a token on another chain; you are launching a Coin (which has its own native blockchain) and managing the underlying network itself.

Process Overview (Extremely High Effort):

- Fundamental Design: Requires a deep understanding of cryptography and distributed systems to design the network's architecture and choose a Consensus Mechanism (e.g., Proof-of-Stake, Proof-of-Work, or a custom variant).

- Core Development: The team must write and maintain all the core software for the network, including the node client, the transaction validation rules, and the initial distribution mechanism for the native coin.

- Network Launch and Security: The launch involves generating the "Genesis Block" and successfully attracting a sufficient number of miners or validators to secure the network. The network's long-term security and ongoing maintenance become the team's permanent responsibility.

Risk Profile (Highest Cost, Critical Failure Points):

- Exorbitant Cost: This requires years of development and a significant budget for highly skilled engineers.

- Security Failure: Any bug in the core code can compromise the entire chain, leading to catastrophic failure.

- Network Effect: The coin only gains value if the team succeeds in convincing other developers, businesses, and users to abandon existing chains and adopt the new one.

Final Conclusion:

The path you choose dictates your resources, risk, and long-term ambition. Issuing a token has never been easier, but building a valuable, safe, and compliant project remains an undertaking of extreme difficulty. Always prioritize legal compliance and comprehensive risk assessment over hype and speed.