11/3/2025

On blockchains — especially Ethereum — every action is performed by software running on distributed computers. Gas measures how much computing work your action requires.

1) The toll road metaphor: why Gas exists at all

Picture Ethereum like a global toll road. Every time you transfer ETH, mint an NFT, or interact with a DeFi protocol, you’re “driving” across shared infrastructure run by thousands of independent nodes. Those nodes verify signatures, execute smart contracts, write data to the chain, and propagate results worldwide — all of which consume real resources: electricity, bandwidth, and hardware. Gas fees are the tolls that keep traffic fair and the road open for everyone.

Without fees, bad actors could spam the network with junk transactions, blocking honest users. Gas turns computation and storage into priced resources so the system can prioritize legitimate activity and remain stable under load.

2) Gas, gwei, and the three knobs you control

In Ethereum, Gas is the unit that measures how much computational work your transaction consumes. You don’t pay in “Gas” itself; you pay in ETH based on two key numbers:

- Gas Used: how many units of computation your transaction actually consumed.

- Gas Price: how much ETH you pay per unit of Gas, usually quoted in gwei (1 gwei = 0.000000001 ETH).

Your total fee is simply Gas Used × Gas Price.

There’s also a third parameter: Gas Limit. This is a safety cap — the maximum Gas you allow your transaction to consume. If execution needs more and you set the limit too low, the transaction can fail with “out of gas,” and you still pay for the work attempted up to that point.

A simple ETH transfer typically uses about 21,000 Gas units. If the network price is 20 gwei, you’ll pay roughly 21,000 × 20 gwei = 0.00042 ETH. If ETH trades at $3,000, that’s about $1.26. More complex actions — like swapping tokens or minting NFTs — consume more Gas because they trigger more computation and more storage writes.

3) Why fees are essential: protection, incentives, and fairness

Gas fees serve three intertwined goals:

- Anti-spam and security: charging for computation prevents denial-of-service attacks.

- Paying real costs: node operators invest in hardware, power, and bandwidth; fees compensate them.

- Fair allocation: when block space is scarce, prices act like an auction. Higher-priority transactions pay more and get included faster.

Data backs this up. Ethereum consistently processes around one to one-and-a-half million transactions per day (Etherscan network charts in 2024). At peak demand — for example, during the 2021 NFT frenzy — fees for complex mints soared over $200 per transaction because thousands of users were bidding simultaneously for limited block space.

4) The modern fee model: EIP‑1559 and burning ETH

Before 2021, users competed entirely via Gas Price bids. Ethereum’s EIP‑1559 changed that by splitting fees into components and making pricing more predictable:

- Base Fee: set automatically by the protocol and adjusted each block based on congestion. Every transaction pays the Base Fee, and it is burned — permanently removed from ETH supply.

- Priority Fee (the “tip”): a small extra amount you add to incentivize validators to include your transaction sooner.

- Max Fee and Max Priority Fee: upper bounds you set so your wallet never overpays during sudden surges.

The Base Fee adjusts toward a target block capacity; in very busy blocks, it moves upward, and in calmer blocks, downward. This dynamic keeps fees responsive without chaotic bidding wars.

The impact has been measurable. By 2024, more than four million ETH had been burned under EIP‑1559 (Ultrasound.money), introducing a deflationary pressure that partially offsets issuance. For users, fee volatility generally became smoother and more predictable.

5) What actually consumes Gas: from “light” to “heavy” work

Not all on-chain actions are equal:

- “Light” operations include ETH transfers and simple token approvals. These involve limited computation and minimal storage changes, often just a few reads and one write.

- “Heavy” operations include swapping on DEXes, complex DeFi interactions, or NFT minting during high demand. They trigger multiple contract calls, internal balance checks, and storage writes — each step adds Gas.

Storage writes are notably expensive, because persisting data on a globally replicated ledger has long-term cost. In Ethereum’s execution model, certain opcodes and patterns — especially writing to new storage slots — consume significantly more Gas than reads or pure computation. If a transaction reverts (fails due to logic), you still pay for the work already done to discover that failure. If it runs out of Gas, it halts mid-execution and you lose the fee spent up to that point — no side effects are committed, but work was still performed by nodes.

6) How transactions get included: mempools, tips, and MEV

When you submit a transaction, it first enters the public “mempool,” where validators or block builders decide which transactions to include next. Your Priority Fee (tip) helps them prioritize your transaction — higher tips tend to get picked sooner, especially in congested periods.

There’s also MEV (Maximal Extractable Value): extra profit that block builders and validators can earn by arranging transactions in certain orders, such as arbitraging price differences or “sandwiching” trades around a large swap. MEV changes incentives at the block-construction layer and can intensify competition during hot market moments. For regular users, the key takeaway is that busy periods and profitable opportunities attract more competition, raising the effective fees and tips required for quick inclusion.

7) Layer 2 and the big fee drop: rollups and proto‑danksharding

Layer 2 (L2) rollups — such as Arbitrum, Optimism, Base, zkSync, and others — batch many transactions off-chain and post compressed proofs or data to Ethereum. Execution happens in the L2 environment, which is cheaper and faster; only the summary data goes to L1, where security is enforced.

In 2024, Ethereum introduced EIP‑4844 (“proto‑danksharding”), adding special “blob” space for L2 data. This dramatically reduced the cost of posting rollup data to L1, cutting typical L2 fees by a factor of three to ten depending on market conditions. As a result, simple transfers on many L2s often cost pennies, and even complex swaps are frequently under a dollar.

Optimistic rollups rely on fraud proofs with a short delay window, while zk rollups use succinct validity proofs to attest that state transitions are correct. Both inherit Ethereum’s security guarantees for data availability. For users, the practical effect is clear: most day-to-day actions can be done far cheaper on L2, with occasional interactions back to L1 when necessary (for bridging, final settlement, or specific on-chain events).

8) When fees spike: real-world patterns

Several forces can push Gas prices upward:

- Event-driven demand: NFT drops, airdrops, new token listings, or memecoin frenzies can pack the mempool with thousands of transactions in minutes. During the 2021 NFT mania, some mints briefly cost over 1 ETH when gas prices exceeded 1,000 gwei.

- Arbitrage and liquidations: volatile markets spawn intense MEV competition as bots race to capture price differences or liquidate undercollateralized loans. This competition lifts tips and pushes Base Fee upward in crowded blocks.

- Time-of-day effects: fees often dip during UTC early mornings when U.S. and Europe are less active and Asia is just waking up. Conversely, overlapping business hours across regions tend to be busier.

Understanding these patterns helps you pick your moment and save money with no extra effort.

9) How to pay less, step by step

You don’t need arcane settings — just a few practical habits:

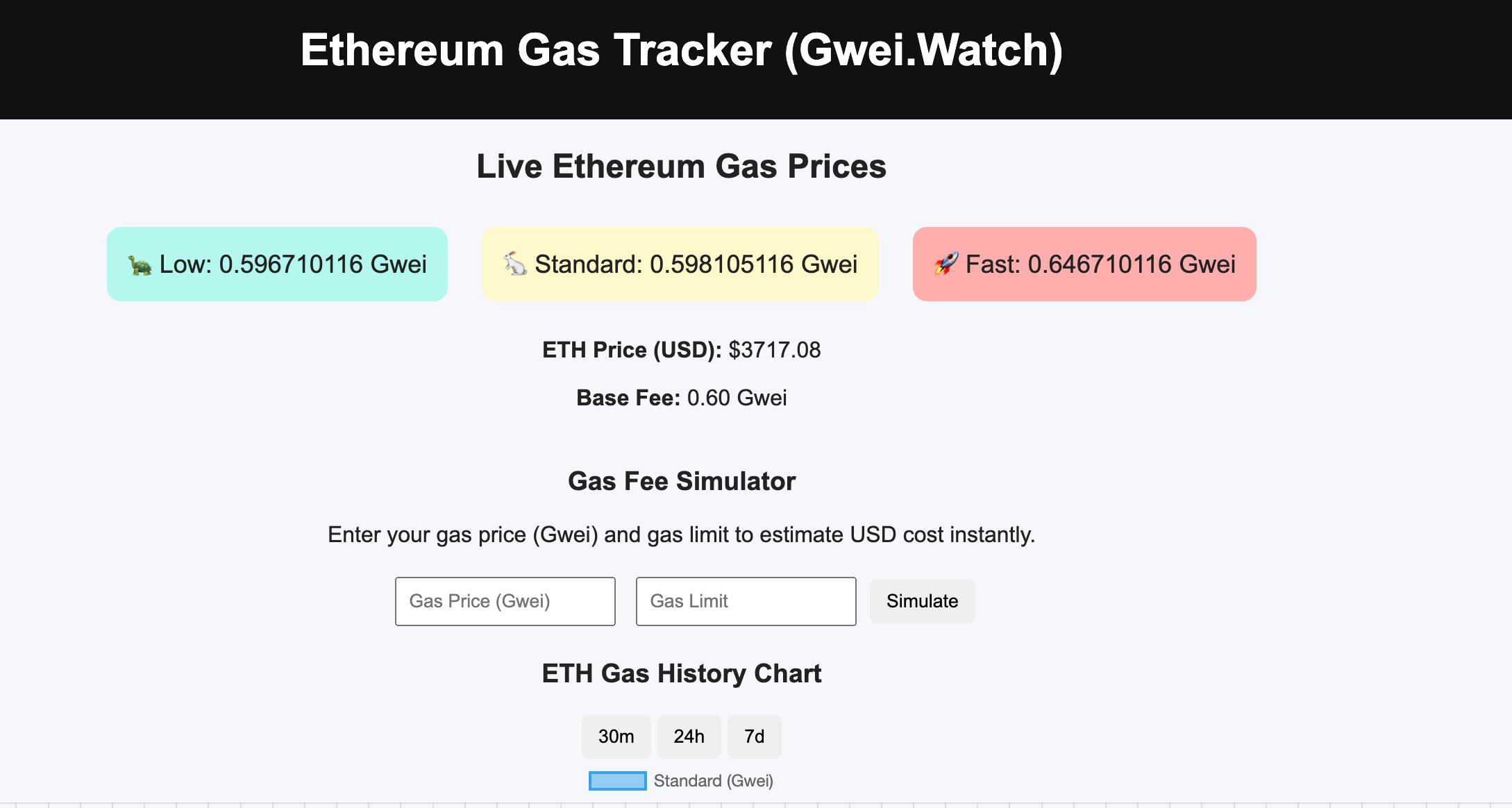

- Check live prices before you transact. Use a gas tracker like Gwei.Watch to see real-time congestion, short-term trends, and suggested ranges for tips.

- Prefer L2 for routine activity. Transfers, approvals, swaps, and mints are often 10× to 100× cheaper off mainnet. Bridge only when necessary.

- Batch when possible. Combining multiple actions into one transaction can save you fixed overhead. Some wallets and dApps offer “multicall” or batch features.

- Avoid waste in your path. On DEXes, reduce multi-hop routes and test different aggregators; small routing differences can cut Gas and slippage.

- Use permits and signatures when available. ERC‑20 “permit” and similar mechanisms let you approve via signature rather than on-chain transactions, reducing extra calls.

- Set sane parameters. Keep Priority Fee moderate and let the Base Fee guide the total. Use reasonable Max Fee caps so you don’t overpay during sudden spikes.

- Simulate before sending. Many wallets and developer tools (e.g., Tenderly, block explorers’ “simulate” features) can show expected Gas Used and failure risks.

- Leverage account abstraction (AA) when suitable. Paymasters sometimes subsidize fees for promoted actions. Always verify the provider and limits.

- Time your actions. If it isn’t urgent, wait for a low-congestion window. A few hours can halve your fee.

10) Safety: avoid the hidden fee traps

A few common pitfalls:

- Phishing and fake interfaces. Be wary of sites prompting abnormally high fees or asking you to grant “unlimited” token approvals. Stick to trusted wallets and verified dApp URLs.

- Out-of-gas and silent reverts. If your transaction fails repeatedly, don’t just crank fees higher; check whether the Gas Limit is too low or if the contract call is reverting due to logic or inputs.

- Stuck transactions. If a low-tip transaction sits pending, you can “replace” it with a new one using the same nonce and a higher tip to speed inclusion. Most wallets offer “speed up” or “cancel” tools.

- Suspicious contracts. Malicious or inefficient contracts can intentionally waste Gas. Favor audited protocols, read permissions carefully, and review social signals and documentation.

11) Quick recap: the mental model that sticks

- Gas measures computation; you pay in ETH, priced in gwei per unit.

- Base Fee is protocol-set and burned; Priority Fee is your tip for faster inclusion.

- Gas Limit is a cap, not a price; too low can cause failure and partial cost.

- Heavy operations (storage writes, complex logic) cost more than lightweight ones.

- L2s and EIP‑4844 make everyday actions far cheaper without sacrificing Ethereum-level security.

- Fees spike during hot events and MEV-heavy windows; timing and network choice matter.

- Use trackers, simulate transactions, and set sensible parameters to save — safely.

12) Final thoughts and resources

Gas is both the fuel that powers decentralized computation and the traffic light that keeps the highway flowing. Understanding how it’s measured, priced, and prioritized will save you money — and help you reason about Web3 like a pro.

Helpful links:

- Real-time gas tracker: https://Gwei.Watch

- Web3 encyclopedia: https://webthree.wiki