9/30/2025

This essential guide for Web3 beginners breaks down the Top 5 cryptocurrencies by market cap—Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), and XRP—explaining their distinct core value propositions, from digital gold and smart contracts to global payments and stable trading.

Welcome to the heart of Web3! If you're new to the space, understanding the sheer volume of tokens can be overwhelming. The best place to start is with the Top 5 cryptocurrencies by market capitalization (Market Cap).

These aren't just coins; they are the foundational infrastructure, primary store of value, and financial lifeblood of the entire decentralized world. Market Cap is the key metric here, calculated as Current Price $\times$ Circulating Supply, reflecting a coin's size and market consensus.

💰 The Big Five: Top 5 Crypto Assets by Market Cap

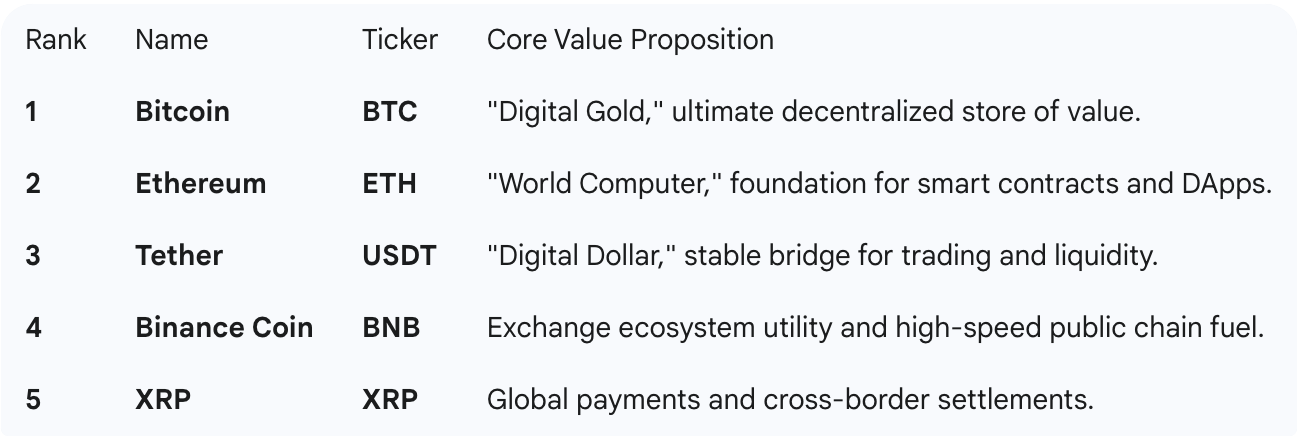

The table below summarizes the five pillars of the crypto market:

1. Bitcoin (BTC): The Ultimate Store of Value

Core Positioning: Digital Gold (Store of Value)

Bitcoin's significance lies not in its speed or smart contract capabilities, but in its representation of scarcity, security, and censorship resistance.

- In-Depth Value: Bitcoin's supply is hard-capped at 21 million coins, making it an ideal counter-asset to fiat currency inflation. Its Proof-of-Work (PoW) consensus mechanism ensures an extremely high degree of security and decentralization, preventing control by any single entity. Institutional investors increasingly view BTC as a legitimate macro store-of-value asset.

- Web3 Role: It serves as the confidence bedrock and the final settlement layer for the entire crypto market.

2. Ethereum (ETH): The "World Computer" of Web3

Core Positioning: Programmable Blockchain

Ethereum is the true engine of Web3, pioneering the smart contract capability that revolutionized how blockchains are used.

- In-Depth Value: Ethereum is an open, decentralized platform that allows developers to build complex applications and logic, including:

- DeFi (Decentralized Finance): Lending, trading, and insurance without traditional banks.

- NFTs (Non-Fungible Tokens): Proof of ownership for digital art, collectibles, and gaming assets.

- DAOs (Decentralized Autonomous Organizations): Governance structured by code, not hierarchy.

- The Merge (PoS): Ethereum's transition to Proof-of-Stake (PoS) significantly reduced its energy consumption and gave its native token, ETH, a new identity as an "income-bearing asset" (through staking rewards) in addition to being the network's "gas fee" fuel.

To dive deeper into the technical logic behind Ethereum and other Web3 concepts, consult WebThree.WIKI for structured knowledge: https://webthree.wiki

3. Tether (USDT): The Stable Financial Blood

Core Positioning: Digital Dollar or Liquidity Bridge

USDT is one of the most traded cryptocurrencies globally, and its importance rivals that of Bitcoin.

- In-Depth Value: USDT is a fiat-collateralized stablecoin, meaning each token is theoretically backed 1:1 by a U.S. dollar or equivalent reserves.

- Market Function: It solves crypto's high volatility problem. Traders use USDT to lock in value or profits without having to withdraw funds to the traditional banking system.

- Efficiency: It enables instant, low-cost value transfer for cross-border payments and arbitrage between exchanges, making it a critical source of market liquidity.

- Beginner Takeaway: Think of it as the primary trading pair in the crypto world, as essential as the USD in foreign exchange.

4. Binance Coin (BNB): Ecosystem and Utility Powerhouse

Core Positioning: Exchange Utility and High-Performance Public Chain Fuel

BNB's growth is a prime example of synergy between a massive exchange and a thriving public chain ecosystem.

- In-Depth Value: BNB's value is driven by two main factors:

- Binance Exchange: As the native token of one of the world's largest crypto exchanges, BNB grants discounts on trading fees, access to new token launches (Launchpad/IEOs), and other ecosystem incentives.

- BNB Chain (formerly BSC): BNB is the fuel for this high-speed public blockchain. The BNB Chain offers an Ethereum alternative with lower fees and faster transactions, attracting a large volume of DeFi and GameFi applications.

- Beginner Takeaway: Holding BNB gives you a utility pass for a top global exchange and provides the fuel for a vast, high-throughput Web3 network.

5. XRP: The Future of Global Payments

Core Positioning: Ultra-Fast, Low-Cost Cross-Border Payments

XRP aims to revolutionize the traditional banking system by offering near-instant and very cheap international money transfers.

- In-Depth Value: Unlike other cryptocurrencies, XRP is not primarily designed for general smart contracts or as a store of value. Its core utility lies in facilitating fast, low-cost cross-border payments for financial institutions. The XRP Ledger (XRPL) can process thousands of transactions per second, making it significantly faster and cheaper than traditional SWIFT payments or even many other blockchain networks for specific use cases.

- Bridging Currencies: XRP acts as a "bridge currency" to efficiently settle transactions between different fiat currencies.

- Beginner Takeaway: XRP is a digital asset built for speed and efficiency in global remittances, a direct competitor to slow and expensive traditional banking transfer methods.

In Summary

The "Big Five" represent the core functions of the modern crypto market: Value Preservation (BTC), Application Platform (ETH), Stable Trading (USDT), Ecosystem Utility (BNB), and Global Payments (XRP).

Understanding their roles is your first step toward navigating the market and making informed decisions. Are you ready to dive deeper into the applications built on these foundations?

If you're ready to start your crypto journey, setting up an account on a leading global exchange is the next step. You can begin your Web3 trading experience through Binance.