10/11/2025

This guide explains the Bitcoin Whitepaper , breaking down the Proof-of-Work system, the longest chain rule, and incentives to show how code, math, and economic incentives replaced the need for banks in online transactions.

Are you ready to understand the DNA of Web3? In late 2008, a mysterious figure named Satoshi Nakamoto released a short, nine-page document that changed the world: "Bitcoin: A Peer-to-Peer Electronic Cash System."

Forget the price charts for a moment. This paper is the master blueprint that explains how we can finally move money online without needing to trust banks, governments, or any central authority.

Here is the Bitcoin Whitepaper, explained in plain English.

Part 1: The Problem Bitcoin Solved

Why do we need Bitcoin at all? Nakamoto argued that the traditional money system has two fatal flaws that Bitcoin was designed to fix:

❌ Flaw 1: The High Cost of Trust

When you pay with a credit card, banks act as "trusted third parties."

- The Issue: Because they are the middleman, they can reverse or block transactions. This creates cost, complexity, and prevents transactions from being truly final.

- The Goal: We need a payment system that is irrevocable (cannot be taken back) and relies on mathematical proof, not trust.

❌ Flaw 2: The Digital "Fake Money" Problem (Double-Spending)

The biggest challenge for any digital currency is simple: How do you stop people from copying their money?

- In the real world, when you give someone a dollar bill, you no longer have it.

- In the digital world, data is easy to copy. If I can send the same Bitcoin to two different people, the whole system collapses.

The Bitcoin Fix: Instead of relying on a bank to keep a private ledger (a record book), Bitcoin uses three interconnected mechanisms to create a single, public, unforgeable history of all transactions.

Part 🧠 3 Core Pillars of the Bitcoin System

These three inventions are the heart of the whitepaper, working together to establish digital trust.

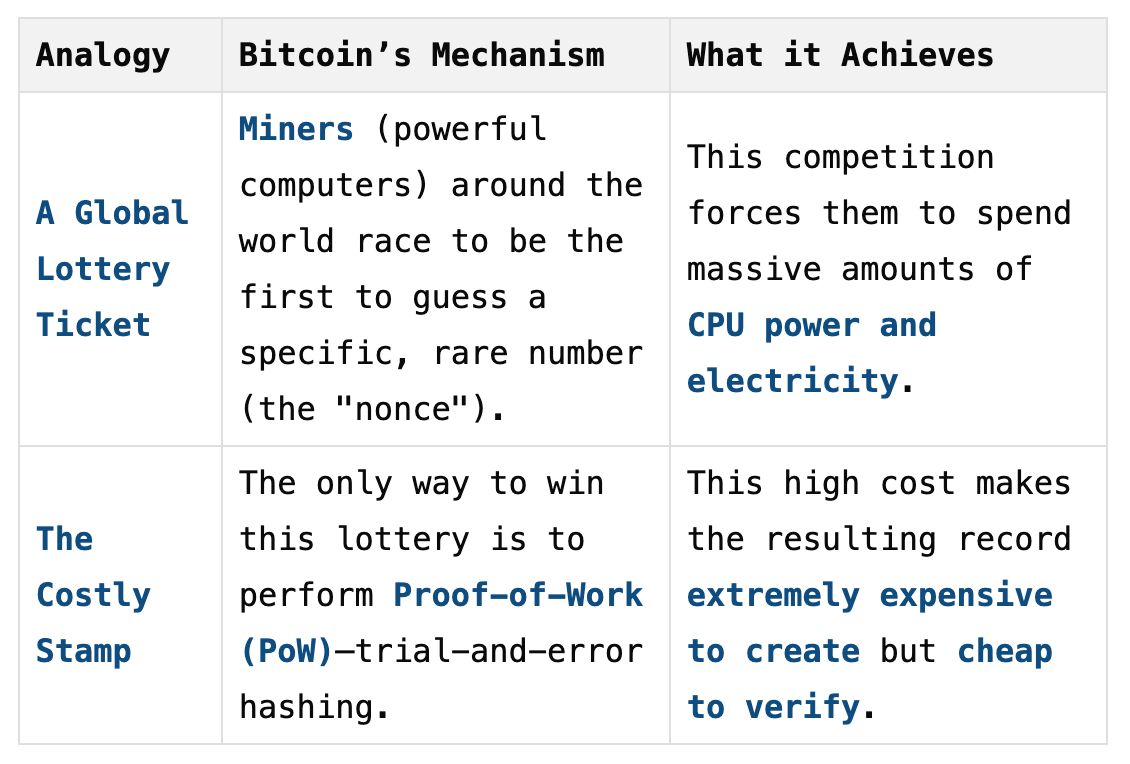

Pillar 1: Proof-of-Work (PoW): The Security Engine

This is the most crucial, most expensive, and most secure part of the system.

Pillar 2: The Blockchain (The Public Ledger)

The PoW mechanism is used to secure the global record book, which is called the blockchain.

- The Block: A block is simply a package of recently confirmed transactions.

- The Chain: To ensure the history can never be rewritten, every new block must contain the cryptographic fingerprint (hash) of the block that came immediately before it.

- The Result: The blocks are permanently locked together in a chain. To change a block from last year, an attacker would have to redo the immense PoW for that block and every single block that has been added since then. This is practically impossible.

Pillar 3: The Longest Chain Rule (The Consensus)

So, what happens if two miners find a block at the exact same time?

- The Rule: All nodes agree to follow the longest chain—the chain that has had the most computational work invested in it.

- Security Through Greed: The whitepaper assumes most miners are honest because they are motivated by the block reward. As long as the honest majority controls the most computing power, the honest chain will always grow fastest and safely outpace any attack chain.

Part IV: Incentives, Scarcity, and the 10-Minute Rule

These final concepts explain why Bitcoin is valuable and why the system remains stable.

💰 The Incentive: Why Miners Play Fair

Miners are not volunteers; they are paid. When a miner successfully completes the PoW and adds a new block, they get two rewards:

- The Block Reward: Newly minted Bitcoin. This is the only way new BTC is created.

- Transaction Fees: Fees paid by users to get their transactions included in the block faster.

⏳ The 10-Minute Design

The system is designed to create a new block every 10 minutes on average.

- Why not 1 minute? If blocks were created too fast, the news wouldn't have time to travel across the entire global network. This would cause chaos, leading to many competing chains and wasting energy.

- Why not 1 hour? Waiting an hour for a transaction to be confirmed would be terrible for business.

- The Balance: Ten minutes is the perfect engineering compromise to allow global communication while still keeping transaction finality reasonably quick.

💎 Scarcity: The "Digital Gold" Feature

The Block Reward halves approximately every four years. This predetermined, slow reduction in new supply guarantees that:

- The supply of new Bitcoin is predictable.

- The total number of Bitcoin will never exceed 21 million.

This guaranteed scarcity is why Bitcoin is often compared to digital gold—it provides a robust defense against currency inflation.

Summary: A New Trust Model

The Bitcoin Whitepaper’s genius is in combining existing cryptography techniques with a radical economic incentive (PoW). It successfully replaces the need for an unreliable, expensive banking system with a transparent, self-regulating, and mathematically secured public ledger.

It launched an entirely new era of finance—the era of Web3.

🔗 Official Bitcoin Whitepaper Links

You can read the original document in its entirety here:

- Bitcoin Whitepaper (English Original): https://bitcoin.org/bitcoin.pdf

- Bitcoin Whitepaper (Simplified Chinese Translation): https://bitcoin.org/files/bitcoin-paper/bitcoin_zh_cn.pdf